On December 21, 2018, CPIP Senior Scholars Jonathan Barnett, Chris Holman, Erika Lietzan, Adam Mossoff, Sean O’Connor, and Kristen Osenga joined a comment letter that was filed with the FTC as part of its ongoing hearings on Competition and Consumer Protection in the 21st Century. The comment letter was joined by 18 legal academics, economists, and former government officials—including former USPTO Director David Kappos and former Federal Circuit Chief Judge Paul Michel. The comment letter is copied below.

On December 21, 2018, CPIP Senior Scholars Jonathan Barnett, Chris Holman, Erika Lietzan, Adam Mossoff, Sean O’Connor, and Kristen Osenga joined a comment letter that was filed with the FTC as part of its ongoing hearings on Competition and Consumer Protection in the 21st Century. The comment letter was joined by 18 legal academics, economists, and former government officials—including former USPTO Director David Kappos and former Federal Circuit Chief Judge Paul Michel. The comment letter is copied below.

***

December 21, 2018

Via Electronic Submission

Mr. Donald S. Clark

Secretary of the Commission

Federal Trade Commission

600 Pennsylvania Avenue NW

Washington, DC 20580

Re: Competition and Consumer Protection in the 21st Century Hearings—

Public Comments Following Hearing #4 on Innovation and Intellectual Property Policy

Dear Secretary Clark,

As legal academics, economists, and former government officials who are experts in antitrust law and intellectual property law, we respectfully submit these comments and an Appendix in response to the request for public comments following the Federal Trade Commission’s Hearings on Innovation and Intellectual Property Policy held October 23-24, 2018, as part of the FTC’s Hearings on Competition and Consumer Protection in the 21st Century.

We support evidence-based policy-making by the FTC concerning all aspects of technological innovation, intellectual property (IP) rights, and the relationship between IP rights and innovation markets. It is imperative that the FTC ground any policy statements, investigations, or enforcement actions, not on academic theories about how IP rights might potentially be misused in stylized theoretical models, but on persuasive evidence of actual consumer harm from anti-competitive practices in real-world markets. Otherwise, regulatory overreach could undermine the economic incentives and resulting stream of innovative products and services that consumers enjoy in markets in which reliable and effective IP rights attract the private capital necessary to fund the high costs of R&D and the commercialization process.

Few economists and policymakers would question that reliable and effective property rights are a necessary predicate for supporting investment in conventional physical-goods markets. Logic holds that this economic principle applies for the innovators, investors, and entrepreneurs in the information technology and life sciences markets at the core of the US innovation economy.

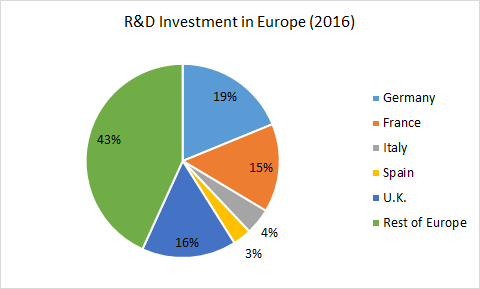

Given reliable and effective IP rights, multiple empirical studies support the proposition that firms are more willing to incur substantial costs and bear significant risks in undertaking long-term R&D. Two well-known examples are the approximately $2.6 billion dollars required to bring a new drug to market or the billions in dollars required to develop new communications technologies like 5G. These and other long-term R&D investments occur in commercial environments in which courts and administrative agencies secure reliable and effective IP rights.

In recent years, antitrust agencies have sometimes taken policy actions in IP-intensive markets that overlook this fundamental connection between secure property rights, investment incentives, R&D, and commercialization activities. These regulatory actions have been based on academic theories and anecdotal reports that have not been put to thoroughgoing, rigorous empirical tests.

To illustrate the risks of making policy without firm empirical support, consider the smartphone industry. For over a decade, theoretical predictions have been made that comparatively high numbers of patents covering technologies used in a single multi-component consumer product—a smartphone—would create “patent thickets,” “royalty stacking,” and “patent holdup” that would increase prices, constrain output, and stunt innovation. Based on these conjectures, antitrust agencies around the world have issued policy statements, undertaken enforcement actions, and imposed billions of dollars in fines—often directed at the firms that had pioneered the fundamental technologies behind wireless communications. Yet those proposing this testable hypothesis never actually tested it. Empirical researchers who subsequently did so found little to no evidence of “patent holdup.” Contrary to theory, real-world market conditions in the smartphone industry are characterized by constant lower quality-adjusted prices, robust market entry by new producers, and continuously increasing performance standards. Consumers in the US and around the globe have benefited from the virtuous feedback effect between secure property rights in new technologies, strong investment flows, and robust R&D output. The evidentiary burden surely rests on those who propose taking policy actions that would erode the property-rights foundation behind this technological and economic success story.

The smartphone industry is just one of multiple innovation markets that exhibit a positive relationship between reliable and effective patent rights, increased innovation, and economic growth. This evidence demonstrates a close relationship in the biopharmaceutical, medical device and certain information technology markets between patent protection and startups’ ability to secure financing for R&D and to undertake the costly commercial task of translating R&D into new products and services for consumers. This relationship is especially powerful in the case of startups that are often the source of breakthrough innovation. One empirical study shows that a startup with a patent more than doubles its chances of obtaining venture capital funding compared to a startup without a patent. Without a secure IP portfolio, venture capital and other investors will decline to support startups that often have few other legal or commercial mechanisms by which to secure their products and services against imitation by larger incumbents. For similar reasons, larger firms that specialize in R&D but do not have downstream production and distribution capacities require a secure IP portfolio to support a licensing infrastructure that generates the returns necessary to fund continued R&D that ultimately benefits downstream companies in the value chain and end-users in the marketplace.

Antitrust policy has long followed an error-cost approach that takes into account the relative costs associated with overenforcement (false positive errors) and underenforcement (false negative errors) of the antitrust laws. Consistent with this approach, the FTC’s policymaking and enforcement actions in innovation markets should be based on valid empirical evidence that makes it possible to weigh the likely costs and benefits of the agency’s actions.

This concern is especially relevant in evaluating the likelihood of consumer harm and the impact on innovation from patent infringement litigation. Like any form of civil litigation, patent litigation can be used for either legitimate or opportunistic purposes. Based on a limited body of evidence that suffers from substantial methodological shortcomings, antitrust agencies have issued statements and taken actions supporting blanket denials of the availability of injunctive relief for all patent owners who primarily license their technologies (“non-practicing entities”).

A broader empirical literature has looked more closely with rigorous analysis and uncovered a far more nuanced market and legal reality. First, no empirical study has demonstrated that patent owners’ requests for injunctive relief after findings of defendants’ infringement of their property rights have resulted systematically either in consumer harm or in slowing down the pace of technological innovation. Second, researchers have found that the “non-practicing entities” or “patent assertion entities” rubric encompasses a large number of business models that generate social gains by providing licensing and other mechanisms for undercapitalized individual inventors, startups, small firms, and universities. These innovators lack the commercial means to extract revenue from R&D that can generate valuable new products and services for consumers. Painting all of these entities with the same rhetorical broad brush threatens to unravel a rich ecosystem of inventors, startups, and entrepreneurs that rely on the legal backstop of injunctive relief to support markets in intellectual assets. Abusive litigation practices by a limited number of patent owners could and should be targeted surgically through fee-shifting and other standard tools available in all civil litigation. Again, regulatory intervention without a firm evidentiary basis runs the risk of harming consumer welfare by undermining the reliable and effective patent rights on which innovators, venture capitalists, startups, and other market participants rely in creating and expanding the innovation markets that benefit everyone.

In support, we attach an Appendix of articles that provide rigorous empirical studies and evidence-based analyses of IP-driven innovation markets, patent licensing, and patent litigation.

In conclusion, the FTC should continue to develop policies and undertake enforcement actions only with evidence of proven harms to consumers and with proper consideration of the costs in undermining reliable and effective IP rights that have consumer-welfare enhancing effects in the US innovation economy. A balanced consideration of the evidence on both harms and benefits is necessary to ensure balanced protection of innovators and consumers. We are confident that a commitment by the FTC to a program of evidence-based policy-making will lead to a vibrant, dynamic innovation economy supported by a secure foundation of IP rights that will continue to benefit consumers in the US and around the world.

Sincerely,

Kristina M. L. Acri

Associate Professor of Economics

The Colorado College

Jonathan Barnett

Professor of Law

USC Gould School of Law

Andrew Beckerman-Rodau

Professor of Law

Suffolk University Law School

Ronald A. Cass

Dean Emeritus,

Boston University School of Law

Former Vice-Chairman and Commissioner,

United States International Trade Commission

The Honorable Douglas H. Ginsburg

Senior Circuit Judge,

United States Court of Appeals for the District of Columbia Circuit, and

Professor of Law,

Antonin Scalia Law School

George Mason University

Stephen Haber

A.A. and Jeanne Welch Milligan Professor

Stanford University

Christopher M. Holman

Professor of Law

UKMC School of Law

Keith N. Hylton

William Fairfield Warren Distinguished Professor

Boston University School of Law

David J. Kappos

Former Under Secretary of Commerce and Director

United States Patent & Trademark Office

Erika Lietzan

Associate Professor of Law

University of Missouri School of Law

The Honorable Paul Michel

Chief Judge (Ret.),

United States Court of Appeals for the Federal Circuit

Damon C. Matteo

Course Professor

Tsinghua University in Beijing

Adam Mossoff

Professor of Law

Antonin Scalia Law School

George Mason University

Sean M. O’Connor

Boeing International Professor of Law

University of Washington School of Law

Kristen Osenga

Professor of Law

University of Richmond School of Law

Matthew L. Spitzer

Howard and Elizabeth Chapman Professor of Law

Northwestern University School of Law

Saurabh Vishnubhakat

Associate Professor of Law

Texas A&M University School of Law

Joshua D. Wright

University Professor,

Antonin Scalia Law School

George Mason University

Former Commissioner,

Federal Trade Commission

APPENDIX

Kristina M. L. Acri, née Lybecker, Economic Growth and Prosperity Stem from Effective Intellectual Property Rights, 24 Geo. Mason L. Rev. 865 (2017), http://georgemasonlawreview.org/wp-content/uploads/2017/11/24_4_Lybecker.pdf

Ashish Arora & Robert P. Merges, Specialized Supply Firms, Property Rights and Firm Boundaries, 14 Ind. & Corp. Change 451 (2005)

Jonathan H. Ashtor, Does Patented Information Promote Progress? (June 22, 2017), https://ssrn.com/abstract=2857697

Jonathan H. Ashtor, Opening Pandora’s Box: Analyzing the Complexity of U.S. Patent Litigation, 18 Yale J. L. & Tech. 217 (2016), https://ssrn.com/abstract=2736556

Jonathan M. Barnett, Antitrust Overreach: Undoing Cooperative Standardization in the Digital Economy (Nov. 2018), https://ssrn.com/abstract=3277667

Jonathan M. Barnett, Has the Academy Led Patent Law Astray?, 32 Berk. Tech. L. J. 1313 (2017), http://btlj.org/data/articles2017/vol32/32_4/Barnett_web.pdf

Jonathan M. Barnett, From Patent Thickets to Patent Networks: The Legal Infrastructure of the Digital Economy, 55 Jurimetrics J. 1 (2014), https://ssrn.com/abstract=2431917

Jonathan M. Barnett, Three Quasi-Fallacies in the Conventional Understanding of Intellectual Property, 12 Journal of Law, Econ. and Pol. 1 (2016), https://ssrn.com/abstract=265636

Christopher A. Cotropia, Jay P. Kesan & David L. Schwartz, Unpacking Patent Assertion Entities (PAEs), 99 Minn. L. Rev. 649 (2014), https://ssrn.com/abstract=2346381

Richard Epstein, F. Scott Kieff & Daniel F. Spulber, The FTC, IP, and SSOs: Government Hold-Up Replacing Private Coordination, 8 J. Comp. L. & Econ. 1 (2012), https://ssrn.com/abstract=1907450

Richard A. Epstein & Kayvan Noroozi, Why Incentives for Patent Hold Out Threaten to Dismantle FRAND and Why It Matters, 32 Berkeley Tech. L. J. (2018), https://ssrn.com/abstract=2913105

Joan Farre-Mensa, Deepak Hegde, & Alexander Ljungqvist, What Is a Patent Worth? Evidence from the U.S. Patent ‘Lottery’ (USPTO Econ. Working Paper No. 2015-5, Mar. 2017), https://ssrn.com/abstract=2704028

Alexander Galetovic & Stephen Haber, The Fallacies of Patent Holdup Theory, 13 J. Comp. L. & Econ. 1 (2017), https://academic.oup.com/jcle/article/13/1/1/3060409

Alexander Galetovic, Stephen Haber, & Lew Zaretzki, An Estimate of the Average Cumulative Royalty Yield in the World Mobile Phone Industry: Theory, Measurement and Results (Feb. 7, 2018), https://hooverip2.org/working-paper/wp18005

Alexander Galetovic, Stephen Haber, & Ross Levine, An Empirical Examination of Patent Hold Up, 11 J. Comp. L. & Econ. 549 (2015), https://academic.oup.com/jcle/article/11/3/549/800066

Douglas H. Ginsburg, Koren W. Wong-Ervin, & Joshua Wright, The Troubling Use of Antitrust to Regulate FRAND Licensing, CPI Antitrust Chronicle (Oct. 2015), https://www.competitionpolicyinternational.com/assets/Uploads/GinsburgetalOct-151.pdf

Douglas H. Ginsburg, Taylor M. Ownings, & Joshua D. Wright, Enjoining Injunctions: The Case Against Antitrust Liability for Standard Essential Patent Holders Who Seek Injunctions, The Antitrust Source (Oct. 2014), https://ssrn.com/abstract=2515949

Stuart J.H. Graham & Ted Sichelman, Why Do Start-Ups Patent?, 23 Berk. Tech. L. J. 1063 (2008), https://ssrn.com/abstract=1121224

Stuart J.H. Graham & Saurabh Vishnubhakat, Of Smart Phone Wars and Software Patents, 27 J. Econ. Persp. 67 (2013), http://ssrn.com/abstract=2291603

Kirti Gupta, Technology Standards and Competition in the Mobile Wireless Industry, 22 Geo. Mason L. Rev. 865 (2015), http://www.georgemasonlawreview.org/wp-content/uploads/2015/06/GuptaTechStandards.pdf

Stephen Haber, Patents and the Wealth of Nations, 23 George Mason L. Rev. 811 (2016), https://ssrn.com/abstract=2776773

Christopher M. Holman, The Critical Role of Patents in the Development, Commercialization and Utilization of Innovative Genetic Diagnostic Tests and Personalized Medicine, 21 B.U. J. Sci. & Tech. L. 297 (2015), http://www.bu.edu/jostl/files/2015/12/HOLMAN_ART_FINALweb.pdf

Ryan T. Holte, Trolls or Great Inventors: Case Studies of Patent Assertion Entities, 59 St. Louis U. L.J. 1 (2014), https://ssrn.com/abstract=2426444

Albert G.Z. Hu and I.P.L. Png, Patent Rights and Economic Growth: Evidence from Cross-Country Panels of Manufacturing Industries, 65 Oxford Econ. Papers 675 (2013), https://academic.oup.com/oep/article-abstract/65/3/675/2362113

Keith N. Hylton, Patent Uncertainty: Toward a Framework with Applications, 96 B.U. L. Rev. 1117 (2016), https://ssrn.com/abstract=2714434

Zorina Khan, Trolls and Other Patent Inventions: Economic History and the Patent Controversy in the Twenty-First Century, 21 Geo. Mason L. Rev. 825 (2014), http://www.georgemasonlawreview.org/wp-content/uploads/2014/06/Khan-WebsiteVersion.pdf

Scott Kieff & Anne Layne-Farrar, Incentive Effects from Different Approaches to Holdup Mitigation Surrounding Patent Remedies and Standard-Setting Organizations, 9 J. Comp. L. & Econ. 1091 (2013), https://www.researchgate.net/publication/274522003_Incentive_effects_from_different_approaches_to_holdup_mitigation_surrounding_patent_remedies_and_standard-setting_organizations

Bruce H. Koboyashi & Joshua D. Wright, Federalism, Substantive Preemption, and Limits on Antitrust: An Application to Patent Holdup, 5 J. Comp. L. & Econ. 1 (2009), https://ssrn.com/abstract=1143602

Bruce H. Koboyashi & Joshua D. Wright, The Limits of Antitrust and Patent Holdup: A Reply to Cary et al., 78 Antitrust L.J. 505 (2012), https://ssrn.com/abstract=2704591

Anne Layne-Farrar, Why Patent Holdout is Not Just a Fancy Name for Plain Old Patent Infringement, CPI North American Column (Feb. 2016), https://www.competitionpolicyinternational.com/wp-content/uploads/2016/02/NorthAmerica-Column-February-Full.pdf

Anne Layne-Farrar, Patent Holdup and Royalty Stacking Theory and Evidence: Where Do We Stand After 15 Years of History?, OECD Intellectual Property and Standard Setting (Nov. 18, 2014), http://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=DAF/COMP/WD%282014%2984&doclanguage=en

Anne Layne-Farrar, Moving Past the SEP RAND Obsession: Some Thoughts on the Economic Implications of Unilateral Commitments and the Complexities of Patent Licensing, 21 Geo. Mason L. Rev. 1093 (2014), http://www.georgemasonlawreview.org/wpcontent/uploads/2014/06/Layne-Farrar-Website-Version.pdf

Gerard Llobet & Jorge Padilla, The Optimal Scope of the Royalty Base in Patent Licensing, 59 J. L. & Econ. 45 (2016), https://ssrn.com/abstract=2417216

Alan C. Marco & Saurabh Vishnubhakat, Certain Patents, 16 Yale J.L. & Tech. 103 (2013), http://ssrn.com/abstract=2324538

Kevin R. Madigan & Adam Mossoff, Turning Gold to Lead: How Patent Eligibility Doctrine is Undermining U.S. Leadership in Innovation, 24 Geo. Mason L. Rev. 939 (2017), http://georgemasonlawreview.org/wpcontent/uploads/2017/11/24_4_Madigan_Mossoff_2.pdf

Keith Mallinson, Don’t Fix What Isn’t Broken: The Extraordinary Record of Innovation and Success in the Cellular Industry under Existing Licensing Practices, 23 Geo. Mason L. Rev. 967 (2016), http://www.georgemasonlawreview.org/wp-content/uploads/Mallinson-FINAL.pdf

Keith Mallinson, Theories of Harm with SEP Licensing Do Not Stack Up, IP Fin. Blog (May 24, 2013), http://www.ip.finance/2013/05/theories-of-harm-with-sep-licensing-do.html

Ronald J. Mann, Do Patents Facilitate Financing in the Software Industry?, 83 Tex. L. Rev. 961 (2005), https://ssrn.com/abstract=510103

Jorge Padilla & Koren W. Wong-Ervin, Portfolio Licensing to Makers of Downstream End-User Devices: Analyzing Refusals to License FRAND-Assured Standard-Essential Patents at the Component Level, 62 The Antitrust Bulletin 494 (2017), https://doi.org/10.1177/0003603X17719762

Kristen Osenga, Formerly Manufacturing Entities: Piercing the “Patent Troll” Rhetoric, 47 Conn. L. Rev. 435 (2014), https://ssrn.com/abstract=2476556

Kristen Osenga, Ignorance Over Innovation: Why Misunderstanding Standard Setting Operations Will Hinder Technological Progress, 56 U. Louisville L. Rev. 159 (2018). https://scholarship.richmond.edu/law-faculty-publications/1502/

Kristen Osenga, Sticks and Stones: How the FTC’s Name-Calling Misses the Complexity of Licensing-Based Business Models, 22 Geo. Mason L. Rev. 1001 (2015), https://ssrn.com/abstract=2834140

Jonathan D. Putnam & Tim A. Williams, The Smallest Salable Patent-Practicing Unit (SSPPU): Theory and Evidence (Sept. 2016), https://ssrn.com/abstract=2835617

David L. Schwartz & Jay P. Kesan, Analyzing the Role of Non-Practicing Entities in the Patent System, 99 Cornell L. Rev. 425 (2014), https://ssrn.com/abstract=2117421

Gregory Sidak, What Aggregate Royalty Do Manufacturers of Mobile Phones Pay to License Standard-Essential Patents?, 1 Criterion J. Innovation 701 (2016), https://www.criterioninnovation.com/articles/sidak-aggregate-royalty-to-license-standard-essential-patents.pdf

Gregory Sidak, The Antitrust Division’s Devaluation of Standard-Essential Patents, 104 Geo. L.J. Online 48 (2015), https://georgetownlawjournal.org/articles/161/antitrust-division-sdevaluation-of/pdf

Gregory Sidak, Testing for Bias to Suppress Royalties for Standard-Essential Patents, 1 Criterion J. on Innovation 301 (2016), https://www.criterioninnovation.com/articles/sidak-bias-to-suppress-sep-royalties.pdf

Matthew Spitzer, Patent Trolls, Nuisance Suits, and the Federal Trade Commission, 20 N.C. J.L. & Tech. 75 (2018), https://scholarship.law.unc.edu/ncjolt/vol20/iss1/2

Daniel F. Spulber, Standard Setting Organizations and Standard Essential Patents: Voting and Markets, Econ. J. (2018), https://doi.org/10.1111/ecoj.12606

Daniel F. Spulber, Patent Licensing and Bargaining with Innovative Complements and Substitutes (June 2018), https://ssrn.com/abstract=2818008

Daniel F. Spulber, How Patents Provide the Foundation of the Market for Inventions, 11 J. Comp. L. & Econ. 271 (2015), https://ssrn.com/abstract=2487564

David J. Teece, Competing Through Innovation: Technology Strategy and Antitrust Policies (Edward Elgar, 2013), https://www.e-elgar.com/shop/competing-through-innovation

David J. Teece, Edward F. Sherry, & Peter Grindley, Patents and ‘Patent Wars’ in Wireless Communications: An Economic Assessment, 95 Comm. & Strat. 85 (2014), https://ssrn.com/abstract=2603751

David J. Teece & Edward F. Sherry, On Patent ‘Monopolies’: An Economic Re-Appraisal, CPI Antitrust Chronicle (Apr. 2017), https://ssrn.com/abstract=2962208

Joanna Tsai & Joshua D. Wright, Standard Setting, Intellectual Property Rights, and the Role of Antitrust in Regulating Incomplete Contracts, 80 Antitrust L.J. 157 (2015), https://ssrn.com/abstract=2467939

Gregory J. Werden & Luke M. Froeb, Why Patent Hold-Up Does Not Violate Antitrust Law (Sep. 24, 2018), https://ssrn.com/abstract=3244425

Joshua D. Wright, SSOs, FRAND, and Antitrust: Lessons from the Economics of Incomplete Contracts, 21 Geo. Mason L. Rev. 791 (2014), http://www.georgemasonlawreview.org/wpcontent/uploads/2014/06/Wright-Website-Version.pdf

Ziedonis, Rosemarie H. and Bronwyn H. Hall, The Effects of Strengthening Patent Rights on Firms Engaged in Cumulative Innovation: Insights from the Semiconductor Industry, in Gary D. Libecap (ed.), Entrepreneurial Inputs and Outcomes: New Studies of Entrepreneurship in the United States (2001).

The Federal Trade Commission’s unfair competition case against Qualcomm, Inc., has now concluded. The parties gave their closing arguments on Tuesday, January 29, and all that remains is Judge Lucy Koh’s ruling. To prevail, the FTC needed to demonstrate actual, quantifiable harm. It completely failed to do so.

The Federal Trade Commission’s unfair competition case against Qualcomm, Inc., has now concluded. The parties gave their closing arguments on Tuesday, January 29, and all that remains is Judge Lucy Koh’s ruling. To prevail, the FTC needed to demonstrate actual, quantifiable harm. It completely failed to do so. On December 21, 2018, CPIP Senior Scholars Jonathan Barnett, Chris Holman, Erika Lietzan, Adam Mossoff, Sean O’Connor, and Kristen Osenga joined a

On December 21, 2018, CPIP Senior Scholars Jonathan Barnett, Chris Holman, Erika Lietzan, Adam Mossoff, Sean O’Connor, and Kristen Osenga joined a

On October 11-12, 2018, CPIP hosted its Sixth Annual Fall Conference,

On October 11-12, 2018, CPIP hosted its Sixth Annual Fall Conference,

As we highlighted in previous posts in this series (see

As we highlighted in previous posts in this series (see