The following post, by Robert R. Sachs, first appeared on the Bilski Blog, and it is reposted here with permission.

It’s been one year since the Supreme Court’s decision in Alice Corp. v. CLS Bank. On its face the opinion was relatively conservative, cautioning courts to “tread carefully” before invalidating patents, and emphasizing that the primary concern was to avoid preemption of “fundamental building blocks” of human ingenuity. The Court specifically avoided any suggestion that software or business methods were presumptively invalid. But those concerns seem to have gone unheeded. The Court’s attempt to side step the tricky problem of defining the boundary of an exception to patent eligibility—”we need not labor to delimit the precise contours of the ‘abstract ideas category in this case'”—has turned into the very mechanism that is quickly “swallow[ing] all of patent law.” The federal courts, the Patent Trial and Appeal Board, and the USPTO are using the very lack of a definition to liberally expand the contours of abstract ideas to cover everything from computer animation to database architecture to digital photograph management and even to safety systems for automobiles.

It’s been one year since the Supreme Court’s decision in Alice Corp. v. CLS Bank. On its face the opinion was relatively conservative, cautioning courts to “tread carefully” before invalidating patents, and emphasizing that the primary concern was to avoid preemption of “fundamental building blocks” of human ingenuity. The Court specifically avoided any suggestion that software or business methods were presumptively invalid. But those concerns seem to have gone unheeded. The Court’s attempt to side step the tricky problem of defining the boundary of an exception to patent eligibility—”we need not labor to delimit the precise contours of the ‘abstract ideas category in this case'”—has turned into the very mechanism that is quickly “swallow[ing] all of patent law.” The federal courts, the Patent Trial and Appeal Board, and the USPTO are using the very lack of a definition to liberally expand the contours of abstract ideas to cover everything from computer animation to database architecture to digital photograph management and even to safety systems for automobiles.

Let’s look at the numbers to present an accurate picture of the implications of the Supreme Court’s decision. My analysis is a data-driven attempt to assess the implications of Alice one year out. It is with an understanding of how the Supreme Court’s decision is actually playing out in the theater of innovation that we can better project and position ourselves for what the future holds.

Alice at Court

As of June 19, 2015 there have been 106 Federal Circuit and district court decisions on § 101 grounds, with 76 decisions invalidating the patents at issue in whole or in part. In terms of patents and claims, 65% of challenged patents have been found invalid, along with 76.2% of the challenged claims.

The success rate of motions on the pleadings (including motions to dismiss and judgments on the pleadings) is extremely impressive: 67% of defense motions granted, invalidating 54% of asserted patents. There has never been a Supreme Court ruling that the presumption of validity does not apply to § 101—only the Court’s use of the originally metaphorical notion that eligibility is a “threshold” condition. Given that, and the general rule that to survive a motion to dismiss the patentee (historically) need only show that there was a plausible basis that the complaint states a cause of action— there is a plausible basis that the patent claim is not directed to an abstract idea, law of nature, or natural phenomena. One would be forgiven for thinking, as did former Chief Judge Rader in Ultramercial, LLC v. Hulu, LLC that a “Rule 12(b)(6) dismissal for lack of eligible subject matter will be the exception, not the rule.” Apparently the rules change in the middle of the game.

Turning specifically to the Federal Circuit, the numbers are stark:

Of the 13 decisions, 11 are in software or e-commerce and only two are in biotech. The one case where the court held in favor of the patentee, DDR Holdings, LLC v. Hotels.com, L.P. appeared to offer a narrow avenue for patentees to avoid invalidation. However, only nine district court opinions have relied upon DDR to find patent eligibility, with over 30 court opinions distinguishing DDR as inapplicable. Even more interesting is the fact that in DDR the Federal Circuit essentially held that creating a website that copies the look and feel of another website is patent eligible. In the Silicon Valley, that’s called phishing, and it’s not a technology in which most reputable companies invest.

Alice at the Office

The impact of Alice is similarly impacting practitioners before the USPTO. In December, 2014 the Office issued its Interim Guidance on Patent Subject Matter Eligibility, providing guidance to patent examiners as to how to apply the Alice, Mayo, and Myriad decisions along with various Federal Circuit decisions, to claims during prosecution. Importantly, the Guidance noted that “the Supreme Court did not create a per se excluded category of subject matter, such as software or business methods, nor did it impose any special requirements for eligibility of software or business methods,” and it reminded examiners that “Courts tread carefully in scrutinizing such claims because at some level all inventions embody, use, reflect, rest upon, or apply a law of nature, natural phenomenon, or abstract idea.” Alas, most patent examiners are acting as if the patent applications before them are the exceptions to these cautionary instructions.

With the assistance of Patent Advisor, I compiled a dataset of almost 300,000 office actions and notice of allowances sampled in two week periods during 2013, 2013, 2014 and early 2015, and all actions during March, April and May 2015, across all technology centers:

About 100,000 actions were notices of allowances, leaving about 200,000 office actions. Each office action was coded as to whether it included rejections under §§ 101, 102 and 103. For each office action the art unit and examiner was identified as well, and the status of the application (abandoned, pending or patented) as of the date that the data was obtained. I then analyzed the data for office actions rejections based on § 101, allowance rates, and examiner rejection rates. Here’s what I found.

Percent of all Actions with § 101 Rejections

Here, we have the percentage of all actions in each period that received a § 101 rejection, considering both rejections issued and notices of allowances. The black line separates pre-Alice from post-Alice data. For example, in TC 1600, the biotech area, in January, 2012 6.81% of all actions issued (counting both office actions and notices of allowances) were office actions with § 101 rejections; by May 2015 that percentage almost doubled to 11.86% of actions.

Overall, data shows that in 2012 subject matter rejections were mainly in the computer related Tech Centers (2100, 2400) and began declining thereafter, while escalating in biotechnology (1600) and so-called “business methods” Tech Center, TC 3600, following Mayo and Alice. Other technology centers such as semiconductors and mechanical engineering had essentially low and constant rejection rates. But that’s not because there are no software patents in these technology centers: you find plenty of software patents in these groups. Rather, my view is that it is because examiners in these groups treat software patents as they do any other technology.

The rejection rates in Tech Center 3600 in the 30-40% range are higher than any other group, but they also mask what’s really going on, since TC 3600 covers more than business methods. Tech Center 3600 has nine work groups:

Percent of all Actions with § 101 Rejections in TC 3600 Work Groups

In TC 3600 most of the work groups handle good old-fashioned machines and processes, such as transportation (3610), structures like chairs and ladders (3630), airplanes, agriculture, and weapons (3640), wells and earth moving equipment (3670), etc. Three work groups handle e-commerce applications: specifically, 3620, 3680 and 3690. Here we see that these groups have significantly higher § 101 rejections than the rest of TC 3600. But let’s drill down further.

Each of work groups 3620, 3680 and 3690 have between five and 10 individual art units that handle specific types of e-commerce technologies, but they are not all under the same work group. For example business related cryptography is handed by both art units 3621 and 3685; healthcare and insurance is handled by art units 3626 and 3686; operations research is handled in 3623, 3624, 3682 and 3684. If we consolidate the data according to technology type and then look at rates of § 101 rejections we get the following:

Percent of all Actions with § 101 Rejections in E-Commerce Art Units by Technology Type

What’s going on? After Bilski in 2010, the § 101 rejections were running between 17% and 50%. Not great but tolerable since these were mostly formal and were overcome with amendments adding hardware elements (“processor,” “memory”) to method claims or inserting “non-transitory” into Beauregard claims.

But after Alice, everything changed and § 101 rejections started issuing like paper money in a hyperinflation economy. If your perception as a patent prosecutor was that the every application was getting rejected under § 101, this explains your pain. Here’s another view of this data, in terms of actual number of § 101 rejections per sample period:

Number of Office Actions with § 101 Rejections in E-Commerce Art Units by Technology Type

Notice here that the number of office actions in March, 2015 fell dramatically, and then in April the flood gates opened and hundreds of actions issued with § 101 rejections. This is consistent with the Office’s statements in January 2015 that it was training examiners in view of the 2014 Interim Guidance, so office actions were being held until the training was completed. Apparently, the training skipped the part about no per se exclusions of business methods.

Now let’s consider notice of allowance rates. First with respect to all Tech Centers.

Percent of Actions that Are Notices of Allowance

This data reflects, of all the actions that were issued in a given period, the percentage that were notices of allowances. (Note here that contrary to the preceding tables, red cells are low percentage, and green cells are high since notices of allowance are good things, not bad things). The numbers look good, with a general increasing trend over time.

Now consider what’s happening in TC 3600’s business methods art units.

Percent of Actions that Are Notices of Allowance in Business Methods

Now the picture is quite different. The rate of NOAs drops dramatically after Alice, especially in finance and banking and operations research. If it seemed that you were no longer getting a NOAs, this is why. The zero percent rate in March, 2015 is a result of the Office holding up actions and NOAs in view of the Interim Guidance training, as mentioned above.

Patents issued in the business methods art units typically are classified in Class 705 for “Data Processing.” I identified all patents with a primary classification in Class 705 since January, 2011, on a month by month basis, to identify year over year trends. Again the black line separates pre-Alice from post-Alice data.

This table shows a precipitous decline in the number of business method patents issued following Alice, especially year over year. The lag between the June, 2014 Alice decision and the drop off in October 2014 is an artifact of the delay between allowance and issuance, as well as the USPTO’s unprecedented decision to withdraw an unknown number of applications for which the issue fee had already been paid, and issue § 101 rejections. It’s an interesting artifact, as well, that the number of Class 705 patents issued peaked in the month after Alice: you have to remember that these patents were allowed at least three months, and as much as a year, before the Alice decision; it just took a long time to actually get printed as a patent.

Next, we’ll consider abandonment rates, on a comparative basis, looking at the percentages of applications that were ultimately abandoned in relationship to whether or not they received a § 101 rejection. We’ll compare the data from January 2012 to July 2014. Again, consider the entire patent corps:

Percent of Abandoned Applications with Prior § 101 Rejection

Here we see that of the applications that were abandoned during the respective sample periods, the vast majority did not have a prior § 101 rejection. Only in TC 3600 did the majority shift after Alice with 51.83% applications that received § 101 rejections in July 2014 being subsequently abandoned by May 31, 2015. Again, let’s drill down into the business method art units in TC 3600:

Percent of Abandoned Applications with Prior § 101 Rejection

First, prior to Alice, abandonments in the business method units appeared to result more frequently from other than § 101 rejections, typically prior art rejections. This is shown by the fact that the Jan. 2012 “No” column (no prior 101 rejection) is greater than the Jan. 2012 “Yes” column. Then after Alice, there is a huge shift with the vast majority of applications that were abandoned having § 101 rejections, as shown by the July, 2014 “Yes” column. The vast majority of abandonments, upwards of 90%, followed a 101 rejection. That’s applicants essentially giving up over what only a few years ago was a relatively minor hurdle. That’s what happens when you change the rules in the middle of the game. Second, there is also significant differential behavior in the business method areas as compared to the rest of the technology centers after Alice.

Here’s my personal favorite.

Rates of Examiner § 101 Rejections in TC 3600

This table shows the numbers of examiners in the business method art units with respect to the percentage of applications in which they issued § 101 rejections after Alice. The first row shows that during the sampled periods since Alice, 58 business methods examiners issued § 101 rejections in 100% of their applications, for a total of 443 applications. Twenty examiners issued § 101 rejections for between 90% and 99% of their cases, covering 370 applications. In short, 199 examiners issued § 101 rejections more than 70% of the time, covering 3,304 applications or about 70.6% of all applications. This is not “treading carefully.”

We find similar, though less dramatic, trends and variations in TC 1600 which handles biotechnology, pharma, and chemistry.

Percent of all Actions with § 101 Rejections in TC 1600 Work Groups

The red line separate pre-Mayo/Myriad data from post-Mayo/Myriad, and the increase in the post-period is significant. Here too, the various work groups mask the more significant rejection rates in specific technology areas, with the rejection rate in microbiology first jumping up to 34.6% post-Mayo and steadily climbing to the current 53.2%.

Percent of all Actions with § 101 Rejections in TC 1600 by Technology

This table breaks down the work groups into technology types, and then these are sorting average rejection rate over the past four months. Following Alice, we see a significant increase in eligibility rejections in bioinformatics related applications–inventions that rely on analysis and identification of biological and genetic information, and which are frequently used in diagnostics and drug discovery. This is especially disconcerting because bioinformatics is critical to the development of new diagnostics, therapies and drugs.

Note as well the enormous spike in rejections for plant related applications from 0% between July 2015 and April 2015, to 50% in May 2015. This is likely a result again of the USPTO’s Interim Guidance which essentially instructed examiners to reject any claim that included any form of a natural product.

At least pesticides and herbicides are safe from Alice, since we definitely need more of those. The irony is that the more pesticides and herbicides that come to market, the more we need bioinformatics inventions to identify and treat conditions potentially resulting from these products.

Alice at the Board

The Patent Trial and Appeal Board has been even more hostile to software and business methods patents under the Covered Business Method review program:

|

Total Petitions

|

Petitions Granted

|

Percent Invalid

|

|

PTAB CBM Institution on § 101

|

72

|

64

|

89%

|

|

PTAB Final Decisions on § 101

|

27

|

27

|

100%

|

Covered Business Method review is available for patents that claim “a method, apparatus, or operation used in the practice, administration, or management of a financial product or service.” The Board takes a very broad view of what constitutes a financial product or service: if the patent specification happens to mention that the invention may be used in a financial context such as banking, finance, shopping or the like, then that’s sufficient. The Board has found CBM standing in 91% of petitions, and instituted trial in 89% of petitions asserting § 101 invalidity. Once a CBM trial has been instituted, the odds are heavily in the petitioner’s favor: of the 27 final CBM decisions addressing § 101, the Board has found for the petitioner 100% of the time.

Finally, we look at the Board’s activity in handling ex parte appeals from § 101 rejections for the period of March 1, 2015 to May 30, 2015:

- 32 Ex Parte Decisions on § 101, with 15 in TC 3600.

- 28 Affirmances overall, 13 in TC 3600

- Two Reversals on § 101, both in TC 3600

- Four New Grounds of Rejection for § 101

Following suit with how the Board is handling CBMs, they are also heavily supporting examiners in affirming § 101 rejections. More disconcerting is the trend of new grounds of rejection under § 101. While only four were issued in this period, there have been several dozen since Alice. In this situation, the applicant has appealed, for example, a § 103 rejection. The Board can reverse the examiner on that rejection, but then sua sponte reject all of the claims under § 101. What are the odds that the examiner will ever allow the case? Close to zero. What are the odds that an appeal back to the Board on the examiner’s next § 101 rejection will be reversed? If the Board’s 100% rate of affirming its CBM institution decisions on § 101 is any indication, then you know the answer.

Conclusions

Looking at the overall context of the Alice decision, it’s my view that Supreme Court did not intend this landslide effect. While they were certainly aware of the concerns over patent trolls and bad patents, they framed their decision not as a broadside against these perceived evils, but as simple extension of Bilski and the question of whether computer implementation of an abstract idea imparts eligibility. At oral argument, the members of the Court specifically asked if they needed to rule on the eligibility of software and they were told by CLS and the Solicitor General that they did not. To the extent that there is broad language in that opinion, it is the cautionary instructions to the courts to avoid disemboweling the patent law from the inside, and the emphasis on preemption of fundamental ideas—not just any ideas—as the core concern of the exclusionary rule. The evidence above shows that these guideposts have been rushed past quite quickly on the way to some goal other than the preservation of intellectual property rights.

If the present trends hold, and I see no reason to suggest that they will not, we will continue to see the zone of patent eligibility curtailed in software (not to mention bio-technology after Mayo and Myriad). Indeed, the more advanced the software technology—the more it takes over the cognitive work once done exclusively by humans, the more seamless it becomes in the fabric of our daily lives—the less patent eligible it is deemed to be by the courts and the USPTO. What technologies will not be funded, what discoveries will not be made, what products will never come to market we do not know. What we do know is this: there is only one law that governs human affairs and that is the law of unintended consequences.

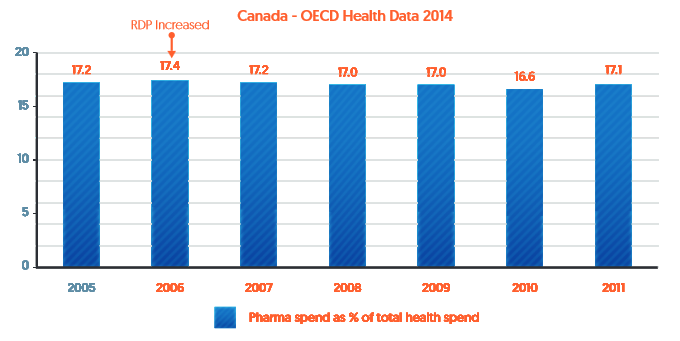

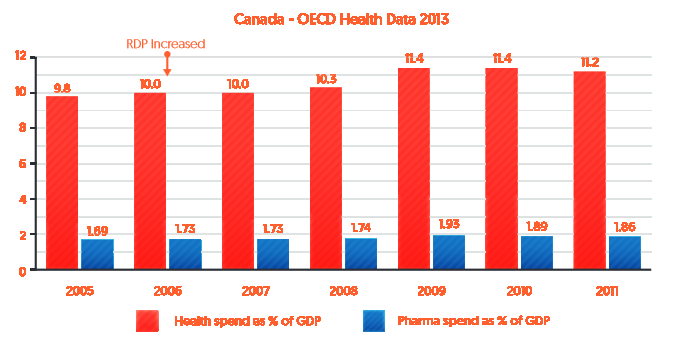

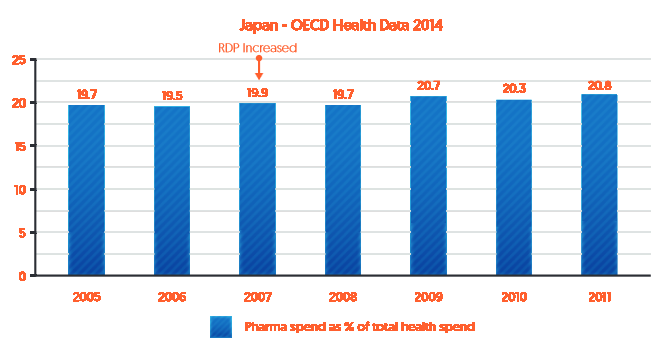

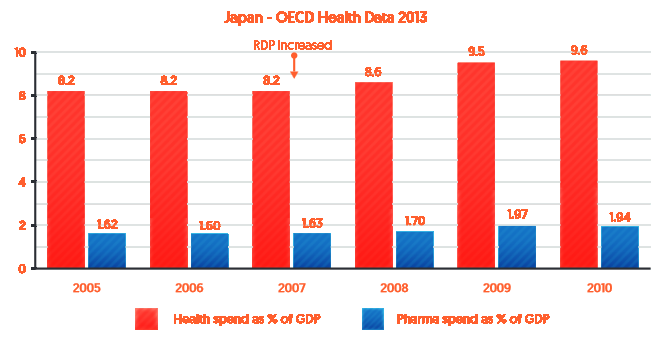

In the Trans-Pacific Partnership (TPP) negotiations, the U.S. and Japan have proposed that TPP partners increase their period of regulatory data protection (RDP) for biologic medicines to align with practice in other countries. These proposals have been strongly opposed by a number of academics, who claim that such a move would significantly increase public spending on medicines, thereby potentially limiting access.

In the Trans-Pacific Partnership (TPP) negotiations, the U.S. and Japan have proposed that TPP partners increase their period of regulatory data protection (RDP) for biologic medicines to align with practice in other countries. These proposals have been strongly opposed by a number of academics, who claim that such a move would significantly increase public spending on medicines, thereby potentially limiting access.

In

In  It’s been one year since the Supreme Court’s decision in Alice Corp. v. CLS Bank. On its face the

It’s been one year since the Supreme Court’s decision in Alice Corp. v. CLS Bank. On its face the  In the last two weeks, the House and Senate Judiciary Committees marked up wide-ranging patent legislation ostensibly aimed at combating frivolous litigation by so-called “patent trolls.” But while the stated purpose of the House and Senate bills—H.R. 9 (the “

In the last two weeks, the House and Senate Judiciary Committees marked up wide-ranging patent legislation ostensibly aimed at combating frivolous litigation by so-called “patent trolls.” But while the stated purpose of the House and Senate bills—H.R. 9 (the “