The following post comes from Colin Kreutzer, a 2E at Scalia Law and a Research Assistant at CPIP.

By Colin Kreutzer

By Colin Kreutzer

This past fall, the United States Patent and Trademark Office (USPTO) hosted a joint workshop with the Department of Justice (DOJ) entitled Promoting Innovation in the Life Sciences Sector and Supporting Pro-Competitive Collaborations: The Role of Intellectual Property. Nyeemah Grazier and Brian Yeh (USPTO Office of Policy and International Affairs (OPIA)) emceed the day’s events, which focused on the impact of patents and copyrights on collaboration and innovation in the life sciences sector. The goal was to promote dialogue between members of the innovation and legal communities working in the life sciences sector to combat the COVID-19 pandemic. Video of day one of the workshop is available here, and our summary of day two is available here.

Opening Remarks

In his opening remarks, Andrei Iancu (USPTO Director and Under Secretary of Commerce for Intellectual Property ) discussed the main purpose of the workshop—to find ways of accelerating American innovation in the life sciences. “Our goal is to enhance collaboration among innovative companies and researchers to solve one of the most vexing health problems we have faced as a country in the past century.” He highlighted the ongoing collaboration between the USPTO and DOJ as “truly innovative.”

Director Iancu also emphasized the positive impact of the patent system on our economy and quality of life throughout American history. He cited the discovery and development of insulin treatments as an example of how innovations have alleviated suffering and helped treat diseases. As an economic example, he noted the massive biopharmaceutical company Amgen, whose co-founder Dr. Marvin Caruthers had once told him that patents are so critical to life sciences development that, without them, the U.S. “would not have a serious biotechnology industry.” Finally, Director Iancu pointed out a number of pandemic-era efforts that the USPTO has undertaken to keep innovation moving forward.

Session I: The role of patents in research and development of therapeutics, diagnostics, and vaccines, particularly during pandemics

In the first session of the day, Ms. Genia Long (Senior Advisor, Analysis Group) gave a presentation on the relationship between patents and innovation, and the value of innovation in improving the diagnostic and therapeutic arena of public health.

Ms. Long explained that technological innovation is a key determinant of economic and public health progress. Disease and morbidity rates have consistently declined over the last thirty years for many serious illnesses such as heart disease, cancer, HIV, and hepatitis. Much of the overall increase in life expectancy in the United States is attributable to pharmaceutical developments. These sorts of improvements are expected to continue into the future, so long as we continue to incentivize and support development in cutting-edge technologies such as gene and cell therapies.

Ms. Long built on Director Iancu’s comments about the core reason that patents are essential in drug development. The cost of developing a drug is extremely high, while the cost of copying a successful drug is very low. Without granting pharmaceutical companies a limited period of exclusivity in which their costs may be recovered, those massive R&D investments are guaranteed to be a losing bet. Realizing this in advance, of course, companies would choose not to make such investments in the first place. And we would have to do without many of the life-enhancing treatments that we now enjoy.

Ms. Long also discussed the importance of collaboration between all government actors who play a role in this innovation ecosystem. In addition to the patenting process, FDA approval takes a large part of the time and money in bringing a drug to market. The Hatch-Waxman Act provided a patent restoration period, adding time to the end of a patent life to compensate for time lost while seeking approval. But the market exclusivity period has remained steady at about 12 to 13 years. Meanwhile, patent challenges from generic drug makers have increased dramatically. Collaboration is important because pharmaceutical patents are “embedded within a larger and somewhat complex system of rules and incentives which act together to yield market results.”

Session II: Update on USPTO guidance on patentability of life science inventions

Next, Ali R. Salimi (Senior Legal Advisor, Office of Patent Legal Administration (OPLA), USPTO) gave an overview of the most recent USPTO guidance to examiners on disclosure and subject matter eligibility analysis.

Mr. Salimi first discussed the rather convoluted history of patent eligibility under 35 U.S.C. § 101. In brief, the Supreme Court has developed a set of judicial exceptions to the four statutory categories of patent-eligible subject matter: process, machine, manufacture, and composition of matter. The Court views these exceptions as necessary to prevent the basic tools of scientific and technical work from becoming inaccessible. As currently written, those exceptions are laws of nature, natural phenomena, and abstract ideas.

Mr. Salimi outlined the 2012-2014 decisions in Mayo v. Prometheus, AMP v. Myriad Genetics, and Alice Corp. v. CLS Bank, as well as the responses by the USPTO in updating its guidance to examiners. The final result was the 2019 updated patent eligibility guidance (PEG) version of the Alice-Mayo test.

The current form of the test is given in a flow chart shown at 42:50 of the video presentation. Step One of the test asks whether the claim is directed to a statutory category. If so, Step Two then asks if a judicial exception renders the claim ineligible—if the claim does recite a judicial exception, it will still satisfy §101 so long as it integrates the exception into a practical application and recites “additional elements that amount to significantly more” than the exception.

Mr. Salimi finished by briefly discussing the three disclosure requirements under § 112: written description (whether the disclosure demonstrates that the inventor actually had possession of the invention), enablement (whether the description enables a person of ordinary skill to make and use the invention), and best mode (whether the inventor knows and discloses the best mode of carrying out the invention).

Overall, he says the 2019 PEG has been well received by both examiners and practitioners, and it has done much to further the goals of clarity and certainty in patent prosecution.

Session III: Life science patents in practice

In this session, two speakers shared their own experiences with how the patent system protects inventions in the life sciences, promotes innovation and facilitates collaboration in life sciences.

David E. Korn (VP of Intellectual Property and Law at PhRMA) spoke first. As a representative of a trade association of leading biotech firms, he elaborated on the concerns about recovering large investments made in the prior remarks of Director Iancu and Ms. Long.

Mr. Korn explained that not only is the drug development process lengthy and costly, but it is also uncertain. Discovery of an active compound is just the beginning. It is followed by initial laboratory and animal testing. If successful, the developer may file an Investigational New Drug (IND) application and begin phase I and phase II clinical trials. This is followed by larger and longer phase III trials involving thousands of patients. If that is successful, the developer may file a new drug application (NDA) to the FDA and seek approval. Only after this process is the drug ready, and drugs can fail at every step along the way. Mr. Korn said the cost of developing a successful drug can be as much as $2.6 billion when accounting for unsuccessful candidates. He likened the process to a rocket mission in which “everything needs to work perfectly at each stage.”

Moreover, Mr. Korn continued, R&D doesn’t stop after FDA approval. There is ongoing research into new forms, new indications, methods of delivery, and multiple therapies. All of these innovations require additional investment and further FDA approval. He credited a number of laws with supporting pharma innovation and collaboration, including the Hatch-Waxman Act, the Orphan Drug Act, and the Bayh-Dole Act.

Next, Dr. Gaby Longsworth (Director, Sterne Kessler Goldstein & Fox) discussed life sciences patents from the perspective of a practicing patent attorney. Patents do more than allow drug developers to recoup their investments. By offering an alternative to holding information as a trade secret, they allow for more open collaboration and licensing in order to “build a common innovation instead of battling it out in litigation.” Patents can also be sold or used as collateral for a bank loan, providing research incentives and support to smaller companies.

First, Dr. Longsworth gave an overview of the three main forms of small molecule drug applications under the Federal Food, Drug, and Cosmetic Act. An NDA can be filed under § 505(b)(1) for new drug compounds, as well as new formulations or indications of an existing drug. A second type is found under § 505(b)(2), known as the paper NDA, for modifications of previously approved drugs based on safety and effectiveness data of the prior drug. Finally, there is the Abbreviated NDA (ANDA) under § 505(j). This is a duplicate application used by generic manufacturers, and it relies on studies provided in the NDA for the original drug.

Next, Dr. Longsworth discussed the general protection strategies of drug innovators. One goal is to build a strong blocking patent. She explained the importance of understanding the different types of patents available when drafting the application in order to obtain claims that will not be easily designed around. Another goal is to create a patent thicket to deter competition. It can become very difficult and expensive for generic competitors to file an ANDA when there are many patents to analyze, and it becomes more difficult for competing innovators to mount successful attacks at the Patent Trial and Appeal Board.

Panel Discussion I: Are changes to U.S. patent law needed to better support innovation in life sciences and the development of COVID-19 solutions?

After hearing several presentations on the effect of economic incentives on innovation, a panel discussion addressed the question of whether changes are needed to improve innovation, collaboration, or access to medicines. Moderated by Director Iancu, the panel featured: The Honorable Paul R. Michel (Chief Judge, U.S. Court of Appeals for the Federal Circuit (CAFC) (Ret.)), Steven Caltrider (VP and General Patent Counsel, Eli Lilly & Co.), Karin Hessler (Assistant General Counsel, Association for Accessible Medicines (AAM)), Arti Rai (Elvin R. Latty Professor of Law and Director, Center for Innovation Policy, Duke University School of Law), Corey Salsberg (VP, Global Head IP Affairs, Novartis), Hans Sauer (Deputy General Counsel and VP, Biotechnology Innovation Organization), and Hiba Zarour (Head of IP Department, Hikma Pharmaceuticals).

Judge Michel noted the problems with uncertainty in § 101 eligibility of patent claims, which he referred to as a “systemic failure” of the courts. If businesses and venture capitalists cannot reliably predict whether a claim will survive § 101, there is less appetite for investment in R&D, less commercialization, and ultimately fewer new medicines. He credited the 2019 USPTO guidance as an improvement but lamented that the Federal Circuit had not gone along with it. The best hope for clarity would not come from the courts, he said, but through new legislation.

Mr. Salsberg noted that from a medical standpoint, the two most important elements for getting through the pandemic are innovation and collaboration. He said the patent system is the reason we entered this pandemic with “libraries of millions of novel compounds that are ready to test right now.” Likewise, it is why we have the tools to sort through these compounds and identify those that can help with COVID-19.

Speaking for generic manufacturers, Ms. Zarour argued that innovation is not solely dependent upon IP protection: “Innovation will happen.” And while previous speakers had argued that it increases innovation, she cited a study from the Swiss Federal Institute of Intellectual Property that found an upper limit on the benefits of patent protection. At a certain point, the stifling effects of IP protection outweigh the benefits of incentivizing investments. She proposed a solution in which the initial patent for a drug would grant the inventor a period of exclusivity (e.g., 15 years) but subsequent or ancillary patents to the same drug would go into a pool that could be voluntarily licensed. This would strike a balance between the need for innovation with the need for access, and it could prevent the “evergreening” of drug patents.

Ms. Hessler also advocated for such a balance. She agreed that strong innovation incentives are responsible for the thousands of COVID-19 compounds that are already in late-stage clinical trials. At the same time, she used an example previously cited by Dr. Longsworth—a 1,000-patent thicket for a biologic manufacturing process—to argue that excessive protection can unduly impede medical access. She mentioned a proposal to cap the number of patents that can be inserted into the biologics patent dance as being a potential solution.

Ms. Hessler also said that settlement of patent litigation is becoming increasingly difficult due to “a patchwork of inconsistent regulations” and disagreement between state and federal laws. Legal settlements can expedite access of generic and biosimilar drugs by over a decade. Mr. Caltrider agreed that the settlement issue is of great importance, and that states such as California are creating laws that interfere with the federal world of patents.

Mr. Sauer said that collaboration is important in biotech because many companies in that field are small. Licensing and technology transfer are critical to the proper function of our biotech ecosystem. The small innovators must have a secure means of profitably transferring their technology to the larger manufacturers who are better equipped to fully develop and deliver the product to the public.

Mr. Caltrider pointed out that the USPTO has remained open for business since the very beginning of the COVID pandemic. Touching on the initiatives that Director Iancu had mentioned in the opening remarks, he praised the certainty and reliability of our patent system as essential to keep “the machinery working” to promote collaboration and innovation.

Prof. Rai pointed to a recent DOJ business review letter which declined to raise antitrust issues over a collaboration between large manufacturers of monoclonal antibodies. She said that from a COVID perspective, the patent system has been doing great. But she echoed Judge Michel’s remarks about § 101, calling the situation a “mess that needs to be fixed.” Finally, she described a forthcoming study on biologics litigation and a proposal regarding manufacturing process patents that are filed after FDA approval.

Session IV: Copyright and innovation in the life sciences

The final sessions of the day shifted to the role of copyright law in the life sciences. Session IV include three short presentations from: Michael W. Carroll (Professor of Law and Faculty Director, Program on Information Justice and Intellectual Property (PIJIP), American University Washington College of Law (WCL)), Mark Seeley (Consultant, SciPubLaw LLC and Adjunct Faculty, Suffolk University Law School), and Bhamati Viswanathan (Affiliate Professor, Emerson College).

Ms. Viswanathan began with a brief overview of copyright law and the balancing act it performs. Most people think of copyrights in terms of music and literature, but it can also protect software, databases, and other compilations of information. Like the patent system, one goal of copyright law is to promote innovations and investment in copyrightable works. And like patents, there exists an issue of balancing the incentive of ownership rights with access to those works. In the scientific community, copyright law seeks to balance the tendency for sharing and collaboration with the rights of the creators of original works.

Mr. Seely discussed two areas of scientific interest that are protected by copyright: scientific journals and searchable data repositories. He says that scientific knowledge is most valuable “when it is organized, standardized, updated, and indexed.” Publishers of scientific data are a crucial component of the current effort against COVID-19 because they provide useable data about known drugs, potential reactions, and other adverse events. By combining “published content, patents, with tactical mining capabilities and analytics,” these works support the pipeline of new treatments.

Prof. Carroll talked about the manner of distributing research outputs within the copyright system. The internet age has brought opportunities for vast dissemination of information. The challenge presented by open access movements has been in finding ways to utilize the internet’s potential while still protecting the IP rights of authors. Open access promotes innovation because it increases exposure of publications to readers beyond those within the narrow discipline from which the publications come, sparking new ideas in an interdisciplinary environment. It also provides information to under-resourced readers in low-income areas or developing nations. Prof. Carroll presented the standardized copyright licenses he helped develop with the Creative Commons organization, which allow authors to choose the particular terms and conditions under which their works are reused or distributed.

Panel Discussion II: Copyright discussion: Enhancing access to life science: How copyright can create incentives or barriers to building data or information pools, and related licensing

Session IV led immediately to a panel discussion by the presenters. Moderator Susan Allen (Attorney-Advisor, OPIA, USPTO) led a discussion of the role of copyright in disseminating information and supporting licensing models.

COVID-19 has resulted in many publishers voluntarily releasing relevant copyrighted information. Asked how this would affect publishing systems long term, Mr. Seeley was doubtful of any major impact. But he noted that downloads of information were much higher due to this change. If society decides, after the fact, that the emergency release was highly beneficial, it could impact future decisions about information sharing.

Prof. Carroll took the increase as an affirmation that open access systems are helping to fill an unmet need. He added that the pandemic has accelerated another trend towards the growth of pre-print servers—publication vehicles for preliminary results and yet unreviewed materials—but noted the growing pains associated with a public that is not accustomed to this type of early information sharing: “clinically actionable unreviewed results that then make it into the media can actually be harmful.”

Asked what role the government can play in supporting copyrights and information sharing, each panelist weighed in. Mr. Seeley said it’s important that governments do more than mandate certain types of publication and sharing—it should be coupled with funding to help make it happen. Prof. Carroll pointed to the recommendations he and others presented as part of the National Academies of Science, Engineering, and Medicine. He echoed Mr. Seely’s call for better funding of information infrastructure such as repositories, as well as better standardization. Ms. Viswanathan voiced support for initiatives like the Open Science Policy Platform (OSPP) and said she would like to see more empirical research on the impact that it has on business models of various stakeholders.

Closing Remarks

In closing, Mr. Yeh thanked the participants and encouraged all to tune in for day two of the conference, which would “explore different ways to expedite the development and use of therapeutics, diagnostics, and vaccines through competition, collaboration, and licensing.”

By Colin Kreutzer

By Colin Kreutzer CPIP has published a new policy brief by Joanna M. Shepherd, Vice Dean and Thomas Simmons Professor of Law at Emory University School of Law. The brief, entitled

CPIP has published a new policy brief by Joanna M. Shepherd, Vice Dean and Thomas Simmons Professor of Law at Emory University School of Law. The brief, entitled  The global COVID-19 pandemic has challenged multiple aspects of modern society in a short time. Health and public safety, education, commerce, research, arts, and even basic government functions have had to change dramatically in the space of a couple months. Some good news in all this is the response of many companies in the intellectual property (IP) industries: they are stepping up to make sure crucial information and materials are available to speed research and development (R&D) towards vaccines, therapeutics, and medical devices. This blog post gives a sampling of the current initiatives facilitating the best innovative work the world has to offer.

The global COVID-19 pandemic has challenged multiple aspects of modern society in a short time. Health and public safety, education, commerce, research, arts, and even basic government functions have had to change dramatically in the space of a couple months. Some good news in all this is the response of many companies in the intellectual property (IP) industries: they are stepping up to make sure crucial information and materials are available to speed research and development (R&D) towards vaccines, therapeutics, and medical devices. This blog post gives a sampling of the current initiatives facilitating the best innovative work the world has to offer. This note explains some of the concepts swirling around in the media right now, relating to medicine approval. Much of what follows appears (or will appear) in an article on the U.S. “right to try” law, which I recently wrote with a colleague at the University of Bourgogne in Dijon, France. Some of the background discussion will be useful here.

This note explains some of the concepts swirling around in the media right now, relating to medicine approval. Much of what follows appears (or will appear) in an article on the U.S. “right to try” law, which I recently wrote with a colleague at the University of Bourgogne in Dijon, France. Some of the background discussion will be useful here. By

By  While recent headlines claim that rising drug prices can be easily addressed through government intervention, the procedures involved with government use of patented technologies are complex and often misunderstood. In addition to owning and practicing a vast portfolio of patents, the government has the power to procure and use patented technologies—including pharmaceutical medicines—in limited circumstances without specific authorization, license, or consent. But despite established mechanisms for government use of intellectual property, some advocates are now promoting an unprecedented and expansive interpretation of procurement that would deprive patent owners of their rights and threaten pharmaceutical innovation.

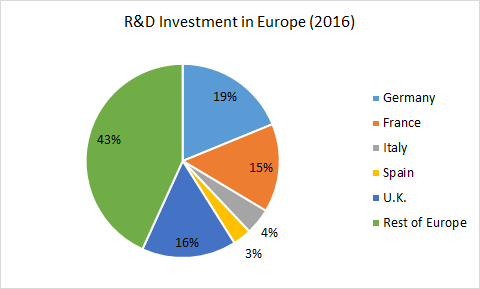

While recent headlines claim that rising drug prices can be easily addressed through government intervention, the procedures involved with government use of patented technologies are complex and often misunderstood. In addition to owning and practicing a vast portfolio of patents, the government has the power to procure and use patented technologies—including pharmaceutical medicines—in limited circumstances without specific authorization, license, or consent. But despite established mechanisms for government use of intellectual property, some advocates are now promoting an unprecedented and expansive interpretation of procurement that would deprive patent owners of their rights and threaten pharmaceutical innovation. Innovation is all around us. We love and appreciate the latest video games, software apps, and smartphones. We await the integration of self-driving cars and other forms of artificial intelligence. Beyond the gadgets and luxuries we think we can’t live without, there are even more essential products that affect the lives of millions around the world on a daily basis. Patented medicines are at the top of the list of innovations that save lives and preserve the quality of life. Unfortunately, some proposed changes to European patent law are jeopardizing the development and delivery of safe and effective drugs, threatening jobs and innovation, and putting global public health at risk.

Innovation is all around us. We love and appreciate the latest video games, software apps, and smartphones. We await the integration of self-driving cars and other forms of artificial intelligence. Beyond the gadgets and luxuries we think we can’t live without, there are even more essential products that affect the lives of millions around the world on a daily basis. Patented medicines are at the top of the list of innovations that save lives and preserve the quality of life. Unfortunately, some proposed changes to European patent law are jeopardizing the development and delivery of safe and effective drugs, threatening jobs and innovation, and putting global public health at risk.

CPIP has published a new policy brief entitled

CPIP has published a new policy brief entitled