Greetings from CPIP Executive Director Sean O’Connor

Greetings from CPIP Executive Director Sean O’Connor

As we move further into 2021 and begin to see hopeful changes with the coming of COVID-19 vaccinations, I hope this year is looking up for you and yours, and I’m grateful to be able to reach out with a good report from CPIP. The newsletter below is the first of CPIP’s revamped quarterly progress reports, which will be replacing our monthly Roundup going forward, and this edition includes scholarship, events, news announcements, and much more from December 2020 through February 2021. We’re proud of all the work and activities of our directors, scholars, and affiliates from not only the past few months but also throughout the challenging year of 2020, and we look forward to sharing more 2021 updates with you in the coming months!

CPIP Hosted & Co-Hosted Events

On January 28-29, 2021, CPIP hosted an online academic roundtable entitled Hot Topics in the Biopharmaceutical Industries from Scalia Law in Arlington, Virginia. The roundtable included academics, industry leaders, judges, and policymakers to discuss issues at the intersection of intellectual property and biopharmaceutical policy, and it featured presentations by leading scholars of original works in progress. Discussion topics included pharmaceutical evergreening, product hopping, incremental innovation, price controls, reference pricing, and compulsory licensing. We had a great turnout at the roundtable with a lively discussion and we are working on several follow-up projects relating to each session. We are interested in putting together case studies covering follow-on innovations, the commercialization pathway, and so-called “me too” patents. Emily Morris is working on an overview of regulatory exclusivities, while Sean O’Connor and Judge Susan Braden, retired Chief Judge of the Court of Federal Claims and CPIP Jurist in Residence, are working on an article covering the history and current application of 28 U.S.C. §1498.

News & Speaking Engagements

Sandra Aistars (CPIP Director of Copyright Research and Policy; Founding Director, Arts & Entertainment Advocacy Clinic; Professor of Law, George Mason University Antonin Scalia Law School)

- Interviewed for a December 30, 2020, article at Communications Daily entitled Expect Legal Challenges Against Recently Passed Copyright Tribunal Bill.

Jonathan Barnett (CPIP Senior Fellow for Innovation Policy & Senior Scholar; Torrey H. Webb Professor of Law, USC Gould School of Law)

- Panelist for CIP Forum 2020 conference’s panel “IP & Entrepreneurship – The impact of IP on startup funding and growth,” on December 1, 2020.

- Discussant for “Intellectual Property and the Constitution” at the Classical Liberal Institute at New York University School of Law on December 3, 2020.

- Quoted in dot.LA’s article from Feb. 8, 2021: “Who Will Biden Pick to Run the US Patent Office?”

Terrica Carrington (Antonin Scalia Law School Alumna and Arts & Entertainment Advocacy Clinic Adjunct Professor; VP of Legal Policy and Copyright Counsel, Copyright Alliance)

- On December 1, 2020, Scalia Law published an article on Ms. Carrington entitled Terrica Carrington ‘16: VP of Legal and Policy and Copyright Counsel at the Copyright Alliance. She now serves as VP of Legal Policy and Copyright Counsel at the Copyright Alliance and continues to work with the Clinic as an adjunct professor. She has recently testified before the House Judiciary Committee on the efficacy of the Digital Millennium Copyright Act (DMCA).

- Carrington played an active role in the Copyright Society of the USA’s 2021 Virtual Midwinter Meeting, which took place over two weeks in February 2021, including moderating a panel discussion entitled The Art of Protest & Activism on Feb. 22, 2021.

Eric Claeys (CPIP Senior Scholar; Professor of Law, George Mason University Antonin Scalia Law School)

- Featured in a short video by the Federalist Society on “Locke & Montesquieu: The Philosophers Behind the Founders” on January 28, 2021.

Christopher Holman (CPIP Senior Fellow for Life Sciences & Senior Scholar; Professor of Law, University of Missouri-Kansas City School of Law)

- Panelist for American Enterprise Institute’s (AEI’s) online event Pricing and financing of pharmaceutical research: Paying twice, paying too much, or paying differently? on December 15, 2020.

Erika Lietzan (CPIP Senior Scholar; William H Pittman Professor of Law & Timothy J. Heinsz Professor of Law, University of Missouri School of Law)

- Appointed Co-Chair of the Annual Conference of the Food and Drug Law Institute (FDLI), a nonprofit organization that focuses on food and drug law. She will also serve as Vice Chair of the Food and Drug Law Committee within the Section of Administrative Law of the American Bar Association.

- Mentioned in the Mizzou Blog Accolades on Feb 5, 2021: “Erika Lietzan elected as a member of CREDIMI”

Sean M. O’Connor (CPIP Executive Director; Founding Director, Innovation Law Clinic; Professor of Law, George Mason University Antonin Scalia Law School)

- Quoted in Laure Schulte’s PolitiFact article from December 1, 2020: “Yes, Americans pay more for remdesivir. No, Trump administration isn’t to blame for that.”

- Presented on “Copyright, Science, and Federalism” on Friday, Feb 12, 2021, during the WIPIP 2021 Online Conference.

- Presented his paper Controlling the Mean of Innovation on Friday, Feb .18, 2021, at the Innovation in a Time of Crisis symposium, which was hosted by the University of Pennsylvania Carey School of Law’s Journal of Law & Innovation.

- Along with CPIP Senior Fellow for Life Sciences Christopher Holman, gave comments on the proposed Bayh-Dole regulations at NIST’s public webinar “Notice of Proposed Rulemaking” on Thursday, Feb. 25, 2021

- Along with CPIP Senior Scholar Eric Priest, presented at the Pepperdine Law Review’s virtual Symposium “Hindsight is 2020: A Look at Unresolved Issues in Music Copyright” on Friday, Feb. 26, 2021.

Kristen Jakobsen Osenga (CPIP Senior Scholar; Austin E. Owen Research Scholar and Professor of Law, University of Richmond School of Law)

- Panel discussant on patent injunctions at the Naples Roundtable on Wednesday, Feb. 17, 2021.

- Presented a work-in-progress about patents for vaccines at the 18th Annual Works-in-Progress Intellectual Property Colloquium (WIPIP) on Thursday, Feb. 18, 2021.

Eric Priest (CPIP Senior Scholar; Associate Professor, University of Oregon School of Law)

- Presented article An Entrepreneurship Theory of Copyright (forthcoming, Berkeley Technology Law Journal, Spring 2021) at the University of Oregon Spring Faculty Colloquium, Thursday, Jan. 28, 2021.

- Discussant on panel “Copyright Protection in China: Turning Music Consumption into Music Revenue” at the Pepperdine Law Review’s virtual Symposium “Hindsight is 2020: A Look at Unresolved Issues in Music Copyright” on Friday, Feb. 26, 2021.

Mark Schultz (CPIP Senior Scholar; Goodyear Tire & Rubber Company Chair in Intellectual Property Law, University of Akron School of Law; Director, Center for Intellectual Property Law and Technology)

- Mentioned in the National Jurist on Dec. 12, 2021: “UAkron to launch Global Trade Secret Institute in Spring 2021.”

- Testified on Feb. 11, 2021 before Senate subcommittee on need to modernize internet copyright law.

Ted Sichelman (CPIP Senior Scholar; Professor of Law, University of San Diego School of Law; Director, Center for Intellectual Property Law & Markets; Founder & Director, Center for Computation, Mathematics, and the Law; Founder & Director, Technology Entrepreneurship and Intellectual Property Clinic)

- February 15, 2021, Private Law Theory post from Steve Hedley promotes Ted Sichelman’s paper Wesley Hohfeld’s Some Fundamental Legal Conceptions as Applied in Judicial Reasoning.

Scholarship & Other Writings

Shyamkrishna Balganesh & Peter S. Menell, Restatements of Statutory Law: The Curious Case of the Restatement of Copyright, 45 Colum. J.L. & Arts ___ (forthcoming 2021)

Jonathan Barnett, Antitrust by Fiat, Truth on the Market (Feb. 23, 2021)

Jonathan M. Barnett, How and Why Almost Every Competition Regulator Was Wrong About Standard-Essential Patents, CPI Antitrust Chron. (Dec. 2020)

Jonathan Barnett, How FTC v. Qualcomm Led to the Nvidia-Arm Acquisition, Truth on the Market (Feb. 17, 2021)

Jonathan Barnett, How Patents Enable Mavericks and Challenge Incumbents, IPWatchdog (Jan. 24, 2021)

Jonathan Barnett, Innovators, Firms, and Markets: The Organizational Logic of Intellectual Property (Oxford Univ. Press 2021)

Eric R. Claeys, Claim Communication in Intellectual Property: A Comment on Right on Time, 100 B.U. L. Rev. Online 4 (2020).

CPIP Staff, Professor Joanna Shepherd Explains Pharmaceutical Product Hopping in New CPIP Policy Brief, CPIP Blog (Dec. 9, 2020)

Wade Cribbs, Hudson Institute Panel Focuses on Patent Litigation in China, CPIP Blog (Feb. 26, 2021)

Loletta Darden, Overlapping and Sequential Copyright, Patent, and Trademark Protections: A Case for Overruling the Per Se Bar, 44 Colum. J.L. & Arts 157 (2021)

Tabrez Y. Ebrahim, National Cybersecurity Innovation , 123 W. Va. L. Rev. 483 (2020)

Devlin Hartline, Ninth Circuit Clarifies Transformative Fair Use in Dr. Seuss v. ComicMix, CPIP Blog (Dec. 22, 2020)

Devlin Hartline, Ninth Circuit Confirms: Fair Use Is an Affirmative Defense to Copyright Infringement, CPIP Blog (Dec. 28, 2020)

Christopher M. Holman, GlaxoSmithKline v. Teva: Holding a Generic Liable for an Artificial Act of Inducement, 39 Biotech. L. Rep. 425 (2020)

Christopher M. Holman, Government Involvement in Pharmaceutical Development Can Come Back to Haunt a Drug Company, 40 Biotech. L. Rep. 4 (2021)

Matthew Jordan, Neil Davey, Maheshkumar P. Joshi, & Raj Davé, Forty Years Since Diamond v. Chakrabarty: Legal Underpinnings and its Impact on the Biotechnology Industry and Society (Ctr. for the Prot. of Intell. Prop. Jan. 2021)

Colin Kreutzer, IP Scholars Question the Legality and Wisdom of Joint AG Proposal to Seize Remdesivir Patents, CPIP Blog (Dec. 16, 2020)

Colin Kreutzer, USPTO-DOJ Workshop on Promoting Innovation in the Life Science Sector: Day One Recap, CPIP Blog (Jan. 12, 2021)

Colin Kreutzer, USPTO-DOJ Workshop on Promoting Innovation in the Life Science Sector: Day Two Recap, CPIP Blog (Jan. 13, 2021)

Christa J. Laser, Certiorari in Patent Cases, 48 AIPLA Q.J. 569 (2020)

Yumi Oda, Professor Daryl Lim Explores the Doctrine of Equivalents and Equitable Triggers, CPIP Blog (Dec. 17, 2020)

Sean M. O’Connor, The Damaging Myth of Patent Exhaustion, 28 Tex. Intell. Prop. L.J. 443 (2020)

Kristen Osenga, Striking the Right Balance: Following the DOJ’s Lead for Innovation in Standardized Technology, ___ Akron L. Rev. ___ (forthcoming 2021)

Sean A. Pager & Eric Priest, Redeeming Globalization Through Unfair Competition Law, 41 Cardozo L. Rev. 2435 (2020)

Mark Schultz, How Can Asian Governments Foster Local Entertainment in the Streaming Era?, The Diplomat (Dec. 11, 2020)

Mark Schultz, IP System Has Brought Light To The Tunnel — Mark Schultz, CodeBlue (Feb. 2, 2021).

Austin Shaffer, Professors Erika Lietzan and Kristina Acri on “Distorted Drug Patents”, CPIP Blog (Feb. 12, 2021)

Joanna M. Shepherd, The Legal and Industry Framework of Pharmaceutical Product Hopping and Considerations for Future Legislation (Ctr. for the Prot. of Intell. Prop. Dec. 2020)

Conor Sherman, Jonathan Barnett on Competition Regulators and Standard-Essential Patents, CPIP Blog (Feb. 17, 2021)

Ted Sichelman, The USPTO Patent Litigation Dataset: Open Source, Extensive Docket and Patent Number Data, Patently-O (Dec. 16, 2020)

Ted M. Sichelman, Wesley Hohfeld’s Some Fundamental Legal Conceptions as Applied in Judicial Reasoning (Annotated and Edited), in Wesley Hohfeld a Century Later: Edited Work, Select Personal Papers, and Original Commentaries (Shyam Balganesh, Ted Sichelman & Henry Smith eds., Cambridge Univ. Press, forthcoming 2021)

Liz Velander, Professor Shyam Balganesh on Understanding Privative Copyright Claims, CPIP Blog (Dec. 8, 2020)

Liz Velander, Senate IP Subcommittee Considers the Role of Private Agreements and Existing Technology in Curbing Online Piracy, CPIP Blog (Jan. 28, 2021)

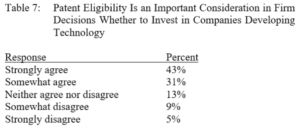

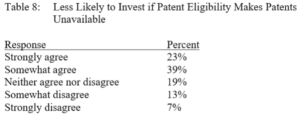

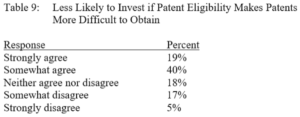

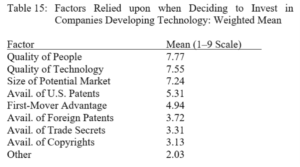

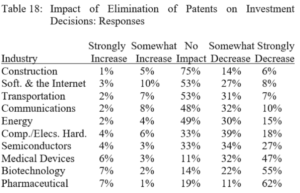

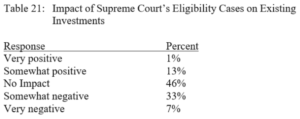

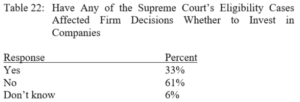

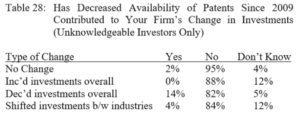

Terence Yen, Professor David Taylor on Patent Eligibility and Investment, CPIP Blog (Feb. 4, 2021)

By Tabrez Ebrahim

By Tabrez Ebrahim By Liz Velander

By Liz Velander By Wade Cribbs

By Wade Cribbs By Wade Cribbs

By Wade Cribbs The Center for Innovation, housed at the University of California Hastings College of the Law, has created an Evergreen Drug Patent Search Database (the “Evergreening Database,” or “Database”).

The Center for Innovation, housed at the University of California Hastings College of the Law, has created an Evergreen Drug Patent Search Database (the “Evergreening Database,” or “Database”). By Connor Sherman

By Connor Sherman