The following post comes from Terence Yen, a 4E at Scalia Law and a Research Assistant at CPIP.

By Terence Yen

In his new paper, Patent Eligibility and Investment, Professor David Taylor of the SMU Dedman School of Law explores whether the Supreme Court’s recent patent eligibility cases have changed the behavior of venture capital and private equity investment firms. The paper comes from CPIP’s Thomas Edison Innovation Fellowship program, and it was published in the Cardozo Law Review. The tables referenced in this summary should be credited to his paper, and readers are encouraged to read the original publication for a deeper understanding of his survey results.

Prof. Taylor explains that, since 2010, the Supreme Court has come out with several decisions that have shaken up our understanding of patent eligibility. Not only do the new standards set forth by the Court lack administrability, but they have also created confusion and have far reaching consequences that have drawn concern and criticism from inventors, scientists, lawyers, judges, and industry groups. In fact, these new standards have required lower courts to make determinations of eligibility that the judges themselves recognize as flawed.

As Prof. Taylor explains, the crux of the issue lies in the Supreme Court’s new patentability standard, which requires an inventive application of a newly discovered law of nature, a natural phenomenon, or an abstract idea beyond the mere practical application of such a discovery, as had been previously required. The result is that a scientist cannot obtain a patent for merely making a new discovery (e.g., the cure to cancer) and disclosing how to apply that discovery to advance the state of the world (e.g., treating a patient using the cure). The inventor must additionally include a disclosure of how to apply the new discovery in a new way, creating a double novelty requirement.

Prof. Taylor points to Ariosa Diagnostics v. Sequenom to illustrate some of the issues with this new standard. In Ariosa, scientists discovered that a pregnant woman’s bloodstream included genetic material from her unborn baby. Upon making this discovery, they used known techniques to create methods to use the material to identify fetal characteristics. These new methods were a significant improvement on prior ones, which required the invasive and risky process of taking samples from the fetus or placenta.

The inventors obtained a patent, but the Federal Circuit was forced to invalidate it because the claimed method did not include any inventive concept transforming this natural phenomenon into a patent-eligible invention. In his concurring opinion, Judge Linn condemned the Supreme Court standard, as it required the court to find that an otherwise meritorious invention was ineligible to obtain the protection it deserved. He particularly criticized the second part of the standard, the requirement of an “inventive concept”, which discounts “seemingly without qualification” any conventional or obvious steps in the process.

Many people have criticized this new two-part test and the additional requirement of an “inventive concept.” Indeed, Prof. Taylor previously condemned this standard as reflecting “a lack of understanding of the relevant statutory provisions, precedent, and policies already undergirding the patent statute.” In this new paper, Prof. Taylor seeks to understand how this has impacted investment decisions, and he begins to compile the data largely missing from the existing literature that would start to shed light on the matter.

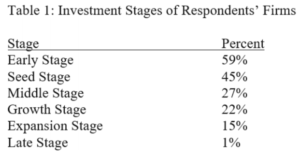

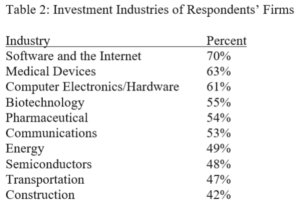

To gather the relevant data, Prof. Taylor conducted a survey of 475 venture capital and private equity investors from at least 422 different firms representing the various early stages of venture capital funding: early, seed, middle, growth, expansion, and late investors. In general, he asked two types of questions:

- Whether the Supreme Court’s rulings on patent eligibility have impacted their decisions to invest in companies developing technology, and if so, how

- Indirect questions related to the same issue, such as asking about any changes to decisions to invest in companies over the relevant time period, and whether those changes relate to any decreased availability of patent protection

The tables below indicate the different stages of venture capital funding represented by the surveyed firms, as well as the variety of represented industries. The total percentages come out to over 100%, because most firms focused on multiple investment stages and industry areas. It should be noted that the survey questions related only to U.S. patents and only to financing activities in the United States.

The Findings

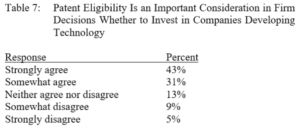

Overwhelmingly, investors reported that patent eligibility is an important consideration for their firms when deciding whether to invest in companies that are developing technology. In total, 74% agreed with this idea, while only 13% disagreed.

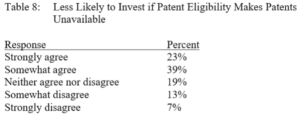

This led to the natural follow-up question: If the laws of patent eligibility make a patent unavailable for a certain technology, would the firm be less likely to invest in companies developing that technology? In response, 62% agreed that their firms would be less likely to invest given the unavailability of patents.

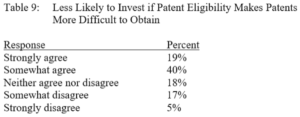

The response changed slightly when the scenario was changed to one where the patent was merely more difficult to obtain. However, there was not a significant change from the response to the previous question, and respondents weighed in at 59% agreement.

From the data collected, it appears that investors in the medical device, biotechnology, and pharmaceutical industries tend to value patentability slightly more than investors in the software space. Additionally, early-stage investors seemed to value patent eligibility slightly more than their late-stage counterparts, though there was not a statistically significant difference reported between the different stages of investment. Prof. Taylor theorizes here that a larger sample size might indicate a more obvious trend.

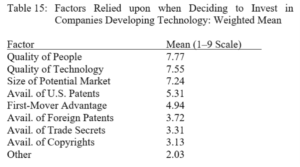

Prof. Taylor notes one interesting statistic: those who were familiar with the Supreme Court’s recent eligibility decisions tended to value patent eligibility higher than those who were not familiar with the cases. This may indicate that the more aware an investor is of the recent opinions, the more they value the impact of those opinions. Prof. Taylor makes sure to note, however, that the data do not preclude the possibility that the more one knows about a subject, the more importance one places on one’s own knowledge of the subject. Additionally, patent eligibility did not appear to be the primary focus for investors. When compared with various other factors typically considered by investment firms, patent eligibility was consistently relegated to a lesser role. It is significant to note that the present survey focused on the availability of patents based only on patent eligibility.

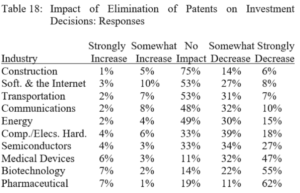

In general, investors indicated that the loss of patent protection would cause them to decrease their investments, though Prof. Taylor finds that this decreased investment would be more pronounced in some industries than others. As shown using weighted averages, the three industries with the greatest reported decrease would be the pharmaceutical, biotechnology, and medical device industries.

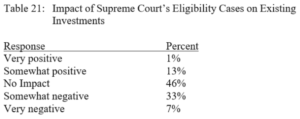

Next, Prof. Taylor explores the impact that the Supreme Court’s decisions have had on investment behaviors. The survey showed that 38% of investors were familiar with at least one of the patent-eligibility cases. About 40% of those knowledgeable investors indicated that the decisions had a negative effect on their firms’ existing investments, compared with 14% who indicated positive effects.

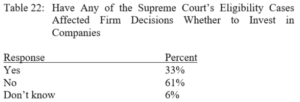

However, Prof. Taylor notes that these numbers represent only the static impact of the Supreme Court cases. Dynamic impact—meaning, the impact on future decision making—is likely the more important statistic. Interestingly, only one-third of investors indicated that the cases would impact their decisions on whether to invest in companies going forward, with no statistically significant difference based on industry or stage of funding.

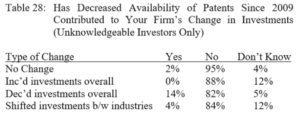

With the numbers above representing investors with knowledge of the patent eligibility cases, it should be no surprise to learn that investors unfamiliar with the Supreme Court cases overwhelmingly responded that the decreased availability of patents had not impacted their firms’ changes in investment behavior.

Conclusion

While there were a wide variety of opinions from the many investors regarding the current state of patent eligibility, the general consensus was that the Supreme Court’s decisions have had a negative impact on patentability, leading to a potential decrease in a willingness to invest. This attitude was most prevalent in, but not limited to, the biotechnology and pharmaceutical industries.

As presented in his paper, Prof. Taylor’s survey provides the first empirical data on how the current state of patent eligibility has affected the attitude of investors. Like all surveys, however, it is susceptible to a certain degree of error caused by various unavoidable human characteristics. Even recognizing its limitations, this survey provides useful information that can be used to begin analyzing the question of whether the Supreme Court’s eligibility cases have impacted investment decision making, and it sheds light on an issue about which many experts in the field have become increasingly concerned.

By Colin Kreutzer

By Colin Kreutzer

By David Ward

By David Ward Last week, a group of CPIP scholars filed an

Last week, a group of CPIP scholars filed an  The Global Innovation Policy Center (GIPC) at the U.S. Chamber of Commerce has just released the sixth edition of its

The Global Innovation Policy Center (GIPC) at the U.S. Chamber of Commerce has just released the sixth edition of its

On December 4, 2017, CPIP Founder

On December 4, 2017, CPIP Founder