By Kevin Madigan & Adam Mossoff

By Kevin Madigan & Adam Mossoff

A key value in the empirical work done in the social sciences and in the STEM fields is that data is made public and available for review, testing, and confirmation. Humans are neither infallible nor omniscient, and thus this standard practice in empirical research has evolved as a way to ensure that mistakes are identified and corrected. All scholars should ensure that their data is accessible, their analysis is understandable, and the means by which they draw their conclusions in both content and method is independently verifiable. As scholars, we embrace these principles.

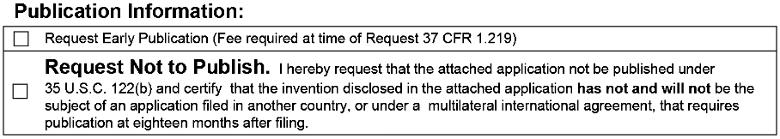

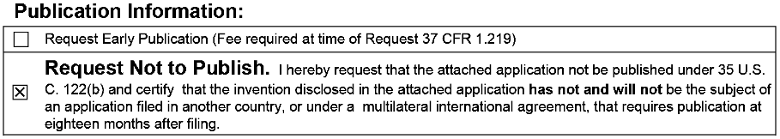

Thanks to our making the data publicly available, we recently discovered that we made a mistake in listing a patent application number in an essay we published on a dataset of patent applications. In Turning Gold to Lead: How Patent Eligibility Doctrine Is Undermining U.S. Leadership in Innovation, George Mason Law Review, vol. 24 (2017), pp. 939-960, we reported on a dataset compiled by David Kappos and Bob Sachs of 17,743 patent applications “that received a § 101 rejection in initial or final office actions and then were abandoned between August 1, 2014 and September 27, 2017” (p. 941, footnote 10). The Kappos-Sachs dataset, as we detail in our article, identifies 1,694 patent applications among these 17,743 applications that received initial or final rejections and were ultimately abandoned in the United States, but patents were granted on the same inventions by the European Patent Office, China, or both.

We used the Kappos-Sachs dataset in our essay to highlight a “disturbing trend” in the U.S. patent system today in comparison to other countries. Our essay does not draw statistical inferences about this dataset, but rather reports on it and contextualizes it within the changes in patent eligibility jurisprudence recently wrought by the U.S. Supreme Court. We compare the more restrictive approach in patent eligibility doctrine in the U.S. today with historically a more open and accessible patent system for cutting-edge innovation in the U.S. The earlier approach led commentators to refer to the U.S. patent system as the “gold standard” compared to the rest of the world. Thus the title of our essay, “Turning Gold to Lead.”

In our essay, we listed twelve patent applications that exemplified this new disturbing trend of the closing of the U.S. patent system to cutting-edge innovation, as compared to other countries (pp. 957-958). In accord with publicly accessible data standards, we identified these twelve applications in a table with their patent application numbers, the titles of the inventions in the applications, the publication dates of the applications, and the assignees of the now-abandoned U.S. applications.

We have since learned that we made a mistake in one of the patent application numbers listed in this table. The invention, “Method for Growing Plants,” is listed as application number US12/139,753. This was a “parent” application that was ultimately rejected on novelty (§ 102) and nonobviousness (§ 103) grounds, but it was not rejected for lack of § 101 patent eligibility. We should have instead listed patent application US12/968,726, which has the same title, “Method for Growing Plants,” and is the “child” application of the mistakenly listed “parent” application.

(For non-patent-law geeks, a “parent” is a patent application during which, while its examination is still pending, the applicant files another patent application on a related invention that is linked to the “parent” in order to receive the earlier invention/filing date of the parent. These patent applications are also linked in the database of applications in the USPTO. This related “child” application is a new application that may disclose new features of or adds new claims to the original “parent.” These additional, related applications are expressly permitted under § 120 and § 121 of the Patent Act.)

We would also like to make clear that our essay reports on the Kappos-Sachs dataset, which comprises patent applications that have been abandoned by the applicants after an initial or final rejection on § 101 patent eligibility grounds. A typo at the end of footnote 10 on p. 941 leaves out the “initial,” and this could be confusing given the earlier sentence in the footnote that refers to both “initial or final rejections.” An example of an initial rejection for lack of § 101 patent eligibility is a patent application in our table on pp. 957-958: patent application US13/746,180, titled “Methods For Diagnosing and Treating Prostate and Lung Cancer.” This patent application received an initial rejection based on § 101 for lack of patent eligibility, but the applicant continued to pursue the application at the USPTO, revising and resubmitting the application in the hope it would be granted. This patent application was ultimately abandoned, just like all the others in the dataset, and the very last rejection before this abandonment was one in which the examiner argued that it was not patentable given its obviousness (§ 103) and a lack of proper disclosure (§ 112).

Pursuant to the terms of the Kappos-Sachs dataset, there was an initial rejection under § 101 for patent application US13/746,180 and it was ultimately abandoned. In fact, given the extensive confusion now in the courts and at the USPTO between the legal standards of § 101 and § 103, as many scholars and others have widely recognized, it is completely unsurprising to find an initial rejection under § 101 morph into a rejection under § 103 after which the applicant then abandoned it (while the corresponding patent for the same invention was granted in other countries where it was not similarly rejected and abandoned).

We regret any confusion that may arise from the dynamic and evolving examination histories of the patent applications in the Kappos-Sachs dataset, and we especially regret listing the wrong “parent” application number instead of the “child” application number.

This is just the start of data collection on the nature and impact of the overly restrictive approach to patent eligibility in the U.S. in the past several years. We hope that scholars trained in rigorous statistical analysis will start to scrutinize the Kappos-Sachs dataset. As we state in the conclusion of our essay:

This Essay highlights empirical data about extensive invalidations of patents by the courts and by the PTO, and hundreds of patent applications rejected in the U.S. but granted for the same or similar inventions in Europe and China. This data reflects a very disturbing trend that portends darkly for the future of the U.S. innovation economy. The data deserves to be mined further with rigorous statistical analysis, investigating more closely issues like technology classes and other relevant variables, but this is beyond the scope of this conference Essay.

Our essay is short and so we invite any interested parties to consider it for themselves. Also, as we said, the dataset is on the Internet and available to all (unlike empirical claims made by others in the patent policy debates that are based in secret, proprietary data and infected with basic methodological problems in statistical analysis).

In conclusion, we wish to express (again) our profound appreciation to David Kappos and Bob Sachs for sharing their dataset with us. We were honored that they gave us permission to report on it. We apologize for any confusion caused by our “scrivener’s error” in listing the wrong patent application number and any confusion caused by an applicant’s ongoing attempts at trying to obtain a U.S. patent before abandoning it after receiving an initial § 101 patent eligibility rejection.

One final minor update is necessary. In our essay, we expressly state that if anyone has questions about the dataset, they should contact Robert Sachs, but the email address is at his old law firm and is now defunct. Bob can now be contacted at rsachs@patentevaluations.com.

Last week, a group of CPIP scholars—Chris Holman, David Lund, Adam Mossoff, and Kristen Osenga—filed an

Last week, a group of CPIP scholars—Chris Holman, David Lund, Adam Mossoff, and Kristen Osenga—filed an  It is undeniable that the patent system has been

It is undeniable that the patent system has been  On February 16, 2017, CPIP hosted a panel discussion,

On February 16, 2017, CPIP hosted a panel discussion,  Following the Supreme Court’s four decisions on patent eligibility for inventions under

Following the Supreme Court’s four decisions on patent eligibility for inventions under  It is common today to hear that it’s simply impossible to search a field of technology to determine whether patents are valid or if there’s even freedom to operate at all. We hear this complaint about the lack of transparency in finding “prior art” in both the patent application process and about existing patents.

It is common today to hear that it’s simply impossible to search a field of technology to determine whether patents are valid or if there’s even freedom to operate at all. We hear this complaint about the lack of transparency in finding “prior art” in both the patent application process and about existing patents.

Alice has been busy the last two months, continuing to haunt the federal courts and the Knox and Randolph buildings at the USPTO. Here are the latest #AliceStorm numbers through the end of October 2015:

Alice has been busy the last two months, continuing to haunt the federal courts and the Knox and Randolph buildings at the USPTO. Here are the latest #AliceStorm numbers through the end of October 2015: